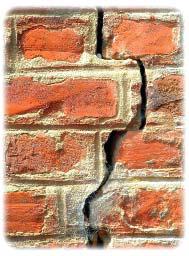

Let me give you an example where it was fortunate that a survey was requested, not just a valuation. I was asked to inspect a 1930’s semidetached house in the Harrow area. The property appeared to be in reasonable order, however, on closer inspection this was not the case.

When you’ve fi nally found a property which fi ts all your requirements, then you will be keen to progress your purchase quickly. In this situation, it is understandable that you may be looking with ‘rose tinted spectacles’ and miss any defects that may be lurking. If you need a mortgage, then you will have to get a valuation… that checks for all those little gremlins which may be there, right? Sadly, wrong. A valuation just tells you what the property is worth, not what needs fixing.

So, let’s go back to our Harrow property. While I was inspecting this property I noted a small damp stain on the ceiling of the kitchen. I tested the area with an electronic moisture meter and obtained high readings – a definite cause for concern. The bathroom was above so I investigated - but couldn’t find an obvious reason for the dampness.

I returned to the kitchen which was in the single storey extension. This joined the house at a point where a wall would have been and where the roof above would have been tied into the original external wall.

So, I set up my 3-meter ladder and climbed up onto the single storey fl at roof to take a closer look. This revealed a whole heap of problems. The render was in a shocking state, the “upstand” had fallen away and two soil pipes were sticking up out of the roof covering with a very poorly detailed junction. It was no surprise that the roof was now leaking and water was coming through the kitchen ceiling!

It just goes to show how important a survey is. In general, there may be nothing wrong, in which case you have ‘peace of mind’, but in so many cases we do discover that repairs are required.

In this particular case, there was a happy ending: our client was able to negotiate the buying price downwards to cover the extra repair costs – so he got his new home, but without any nasty, additional builder’s costs. Don’t think that because the bank has instructed a valuation you have had a survey - you haven’t. Always have, at the very least, a condition survey or a home-buyers report.

Rumball Sedgwick has offi ces in Watford and St Albans. If you need a survey for your next property purchase, then please contact Tim Hollingsworth on 01923 200096 or tim@rumballsedgwick.co.uk

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereComments are closed on this article